Nowhere to Go in NJ: Housing Squeeze Tightens Grip on Both Buyers and Renters

Will be still love it with these rent and home prices?

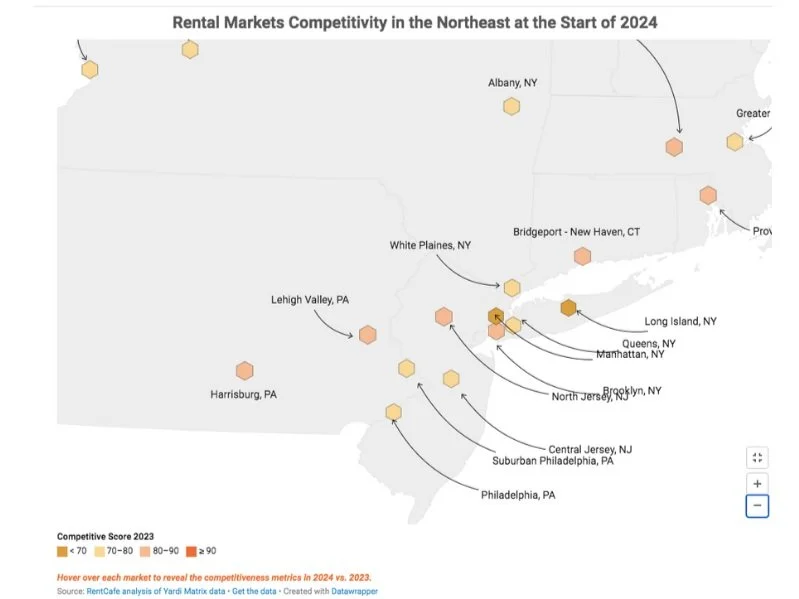

While Miami takes the national crown for the hottest rental market in the early months of 2024, a different story unfolds closer to home. New Jersey, particularly the northern region, is experiencing a surge in rental competition, mirroring a trend across the Midwest. This shift suggests a significant change in renter preferences, driven by affordability, economic opportunities, and lifestyle factors.

The National Landscape: A Shift Towards Affordability

The national rental market in early 2024 shows a moderate level of competition with a Rental Competitiveness Index (RCI) score of 73.4 (RentCafe, 2024). This indicates a renter's market with more options available compared to the previous year. The number of days vacant apartments stay empty has increased to 41 days, primarily due to the influx of new constructions (0.67% of the total housing supply). Unsurprisingly, this has led to a slight dip in the national occupancy rate (93% in 2024 compared to 94.2% in 2023).

Miami's Enduring Allure

Despite the national trend, Miami continues to be the hottest rental market, boasting an RCI score of 91.9. Its thriving economy, fueled by tourism, finance, technology, and international trade, creates a constant demand for apartments. Additionally, Miami's desirable location, pleasant weather, and laid-back lifestyle make it an attractive option for professionals and tourists alike.

The Rise of the Midwest: A Haven for Renters

The most compelling aspect of the RentCafe report is the dominance of the Midwest in the top rental markets. This region offers a significantly lower cost of living compared to other areas, making it an attractive alternative for renters facing rising costs elsewhere. Furthermore, the rise of remote work has fueled the demand for larger living spaces in previously overlooked areas. Interestingly, despite having fewer new apartment options compared to 2023, the Midwest presents a competitive rental landscape due to high renter demand and limited existing inventory.

New Jersey's Competitive Market: North Jersey Leads the Charge

Image Courtesy of: https://www.rentcafe.com/blog/

New Jersey, particularly the northern part of the state, reflects the national trend of rising rental competition. This can be attributed to several factors:

High Cost of Homeownership: The median home sale price in New Jersey reached a record high of $475,000 in February 2024, according to NJ Realtors: [invalid URL removed]. This significant financial hurdle pushes many residents towards the rental market.

Limited Apartment Inventory: Similar to the national trend and the Midwest market, there's a lack of available apartments in New Jersey, leading to fierce competition for existing units. According to Zillow, the median rent for all bedrooms and property types in New Jersey is $2,500, which is $120 more than March 2023 Zillow: https://www.zillow.com/rental-manager/market-trends/nj/. However, the number of available rentals in New Jersey is significantly lower compared to the national average.

Proximity to New York City: North Jersey locations like Jersey City, Hoboken, and Union City offer renters the advantage of being close to New York City at a more affordable price point. A report by NJ.com highlights that Jersey City has experienced a whopping 44.5% increase in one-bedroom apartment prices year-over-year, indicating the high demand in these areas.

Looking Ahead: New Jersey's Rental Market

While not topping the charts like Miami, New Jersey's position as the third hottest rental market in the early months of 2024 signifies a significant shift. With its proximity to major economic centers, a growing job market, and a diverse range of communities, New Jersey is poised to remain a competitive rental market. As the national trend towards affordability continues, New Jersey is likely to see a sustained demand for rental units, particularly in areas with easy access to transportation and job opportunities.

Additional Considerations:

Impact on Renters: The competitive rental market in New Jersey can pose challenges for renters. Rising rents coupled with limited availability can make it difficult to find suitable housing, especially for low- and middle-income residents.

Impact on Landlords: The high demand for rentals can benefit landlords as they are able to command higher rents. However, it's crucial to maintain a balance to ensure a healthy rental market that caters to both renters and landlords.

**The Role of Policy New Jersey's Rental Market Heats Up: A Midwestern Trendsetter (continued)

The Role of Policy

The rising cost of housing and the competitive rental market have become pressing issues in New Jersey. Policymakers are exploring various solutions to address these challenges, including:

Increasing Housing Supply: Encouraging the development of new apartments, particularly affordable housing units, can help ease the pressure on the rental market. This might involve zoning reforms and financial incentives for developers.

Rent Control and Tenant Protections: While rent control can stabilize rents for existing tenants, it can also discourage new development. Finding a balance between protecting tenants and encouraging new construction is crucial. Additionally, strengthening tenant protections, such as ensuring a fair eviction process and addressing habitability concerns, can create a more secure environment for renters.

Investment in Public Transportation: Investing in public transportation infrastructure can make more areas of New Jersey accessible to renters, particularly those seeking more affordable options outside major urban centers. This can help alleviate pressure on high-demand areas like North Jersey.

Conclusion

New Jersey's rental market is experiencing a significant shift, mirroring a national trend towards affordability and a regional trend seen in the Midwest. The high cost of homeownership, limited apartment inventory, and proximity to major economic centers are driving up rental competition in the state. While this presents challenges for renters, it also offers opportunities for policymakers to explore solutions that create a more balanced and sustainable rental market for the future.