NJ Earns a Spot on This List: Worst States To Buy A Home in Right Now

Finding the perfect place to call home is a significant decision, especially for those looking to escape the high costs and challenges of living in New Jersey. Key factors like cost of living, crime rates, climate change, local issues, and property taxes can greatly influence your choice. Whether you’re saving for a house, waiting for mortgage rates to drop, or planning a big move, diving into market research now is the smartest move.

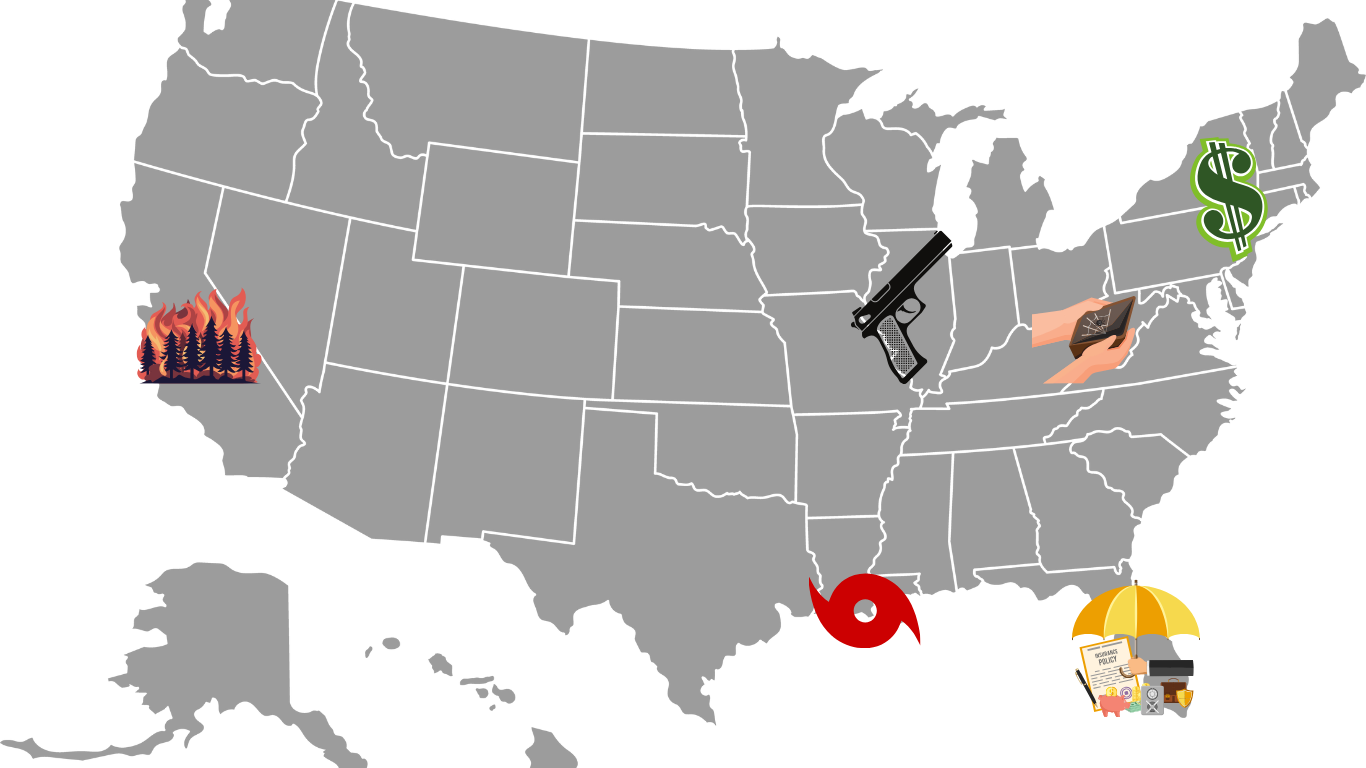

Based on the latest market trends, experts have identified several states that might be best to avoid if you’re looking to buy property in the next five years. Here’s why these states made the list.

1. California: A Pricey Paradise

California is famous for its stunning scenery, vibrant culture, and perfect weather. However, the high cost of living can be a major deterrent for potential homeowners. The median home price in California was $800,000 as of 2023, significantly higher than the national median of $400,000 . The state also faces significant issues like wildfires and droughts, which can make homeownership challenging and expensive. In 2023 alone, California experienced over 9,000 wildfires, burning more than 4 million acres of land . The tech boom, particularly in the Bay Area, has driven housing prices to astronomical levels, pushing many to seek more affordable living elsewhere. California’s allure might be turning into a financial burden for would-be homeowners.

2. Florida: Sunny but Stormy

Florida’s sunny climate attracts many retirees, but the state's vulnerability to hurricanes and rising sea levels poses significant risks. According to the Insurance Information Institute, Florida had the highest average homeowner's insurance premium in the nation at $2,165 per year in 2023 . Florida homeowners face challenges such as high insurance premiums, costly rebuilds, and major disruptions due to storm damage. Coastal properties could lose significant value if rising sea levels make them uninhabitable. According to NOAA, Florida's sea levels are rising at an average rate of 1 inch every 3 years . Prospective buyers should be prepared for these potential challenges.

3. Illinois: High Taxes and High Crime

Illinois, known for its bustling cities and agricultural heartland, is currently grappling with economic challenges. The state has some of the highest property taxes in the country, with an effective rate of 2.27% in 2023, compared to the national average of 1.07% . Chicago, in particular, faces a high crime rate, with over 630 homicides reported in 2023 . Additionally, budget deficits have led to cuts in essential services and increased taxes. These financial strains make it difficult for residents to justify staying when they could find a safer and more financially stable environment elsewhere.

4. Louisiana: Climate Concerns

Louisiana offers vibrant culture and culinary delights, but it is highly susceptible to climate change impacts like hurricanes and flooding. In 2021, Hurricane Ida caused an estimated $75 billion in damage . These risks can lead to higher insurance costs and potential property damage. Additionally, the state struggles with lower job growth, with a job growth rate of only 0.3% in 2023, compared to the national average of 1.2% . Economic diversification is limited, making Louisiana less attractive for long-term investments. Infrastructure issues also add to the challenges of property ownership here.

5. New Jersey: Taxing Times

If you’re thinking of investing in the Garden State, consider the high property taxes and the exodus of major corporations, which impacts job availability. New Jersey has the highest property taxes in the nation, with an effective rate of 2.49% . The state also has some of the highest health insurance premiums, with an average premium of $452 per month in 2023 . Furthermore, congestion and traffic, especially for those commuting into New York City, can be a daily frustration, with the average commuter spending 45 minutes each way in traffic .

6. New York: Big Costs in the Big Apple

New York is a high-priced state with more issues than just the cost of living. The state has high property taxes, with an effective rate of 1.72% in 2023 . New York City, in particular, faces challenges like aging infrastructure. The subway system, for example, is notorious for delays and breakdowns, with over 76,000 delays reported in 2023 . Additionally, the shift to remote work during the pandemic has reduced the need to live in or near the city, prompting many to relocate to suburban or rural areas.

7. West Virginia: Economic Decline

West Virginia, traditionally coal country, is facing economic challenges as the industry declines. As jobs disappear, small towns are seeing population declines, resulting in reduced demand for housing. The state's population decreased by 3.3% from 2010 to 2020 . Homeowners may find it challenging to attract buyers willing to pay fair prices. Additionally, West Virginia has one of the lowest median household incomes in the nation, at $48,850 in 2023, compared to the national median of $70,784 .

Choosing where to buy a home is a complex decision influenced by many factors. For those in New Jersey looking to move, consider these states' challenges and weigh them against your needs and financial situation. Stay informed and make the best choice for your future.