Is Another Housing Bubble Brewing? DTI Ratios Hit Record Highs

The American dream of homeownership has long been a cornerstone of financial security and prosperity. However, a recent trend in the housing market raises concerns about the financial health of homebuyers – the steady rise of the Debt-to-Income (DTI) ratio. This metric, calculated by dividing a borrower's total monthly debt payments by their gross monthly income, reflects the portion of income dedicated to servicing existing debts. A higher DTI signifies a greater financial burden and potentially less wiggle room for unexpected expenses.

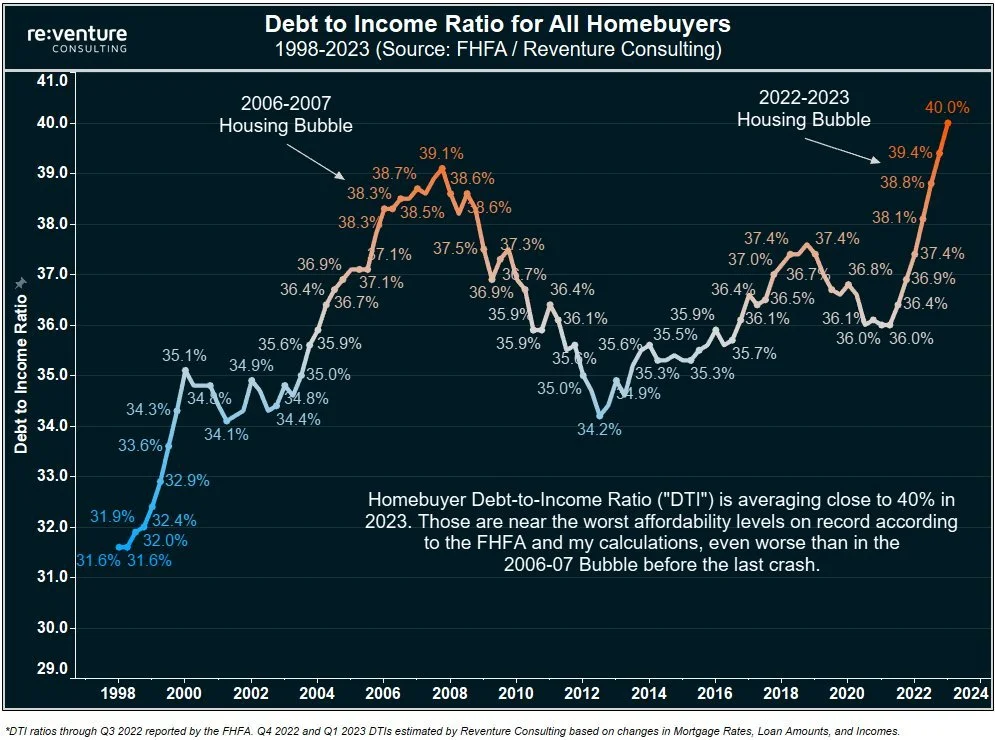

An analysis by Reventure Consulting reveals a troubling trend: the DTI ratio for US homebuyers has been steadily climbing since 1998, reaching a peak of around 40% in 2022 and 2023. This aligns with the Federal Housing Finance Agency's (FHFA) assessment, placing affordability at some of its lowest points in history. While the data for the most recent quarters is an estimate, the overall trend paints a clear picture – American homebuyers are carrying a heavier debt load than ever before.

Echoes of the Past: A Haunting Parallel

This rise in DTI ratios evokes a sense of déjà vu, particularly when compared to the pre-2008 housing bubble. During that period, soaring DTI ratios, fueled by easy credit and lax lending standards, were a key factor in the financial crisis. Borrowers with high debt burdens found themselves underwater on their mortgages when housing prices plummeted, leading to a wave of foreclosures and economic devastation.

While the current situation may not be a perfect parallel, the similarities are concerning. Similar anxieties are playing out in specific regions like New Jersey, a state known for its high cost of living. According to a 2023 report by NJ.com, the median home price in the state surpassed $400,000 for the first time. Coupled with rising interest rates and stagnant wages, New Jersey residents are facing a particularly challenging affordability squeeze. This translates to a potentially higher DTI for New Jersey homebuyers, increasing their vulnerability to financial hardship.

The Culprits Behind the Climb: A Perfect Storm

Several factors are contributing to the rise in DTI ratios. One significant driver is the relentless rise in housing prices. The National Association of Realtors (NAR) reports a steady increase in national median home prices over the past decade. This surge in price outpaces wage growth, making homeownership less attainable for many Americans.

Adding fuel to the fire are rising mortgage rates. After years of historically low rates, the Federal Reserve has begun raising rates to combat inflation. This increase translates to higher monthly mortgage payments, further straining household budgets and pushing the DTI ratio upwards.

A Debt-Laden Future: Potential Consequences and Solutions

The consequences of high DTI ratios can be severe. Homeowners with limited financial flexibility are more susceptible to foreclosure if they experience job loss, illness, or other unforeseen circumstances. This can have a domino effect on the broader economy, as a wave of foreclosures can destabilize the housing market and hinder economic growth.

So, what can be done to address this concerning trend? A multi-pronged approach is necessary. On the one hand, policies aimed at increasing housing supply could help stabilize prices and improve affordability. Additionally, stricter lending standards, while potentially making it more difficult to qualify for a mortgage, could prevent borrowers from taking on unsustainable debt burdens.

The Road Ahead: A Look Towards the Horizon

Predicting the future with certainty is impossible. However, by examining past trends and the current economic landscape, we can make some educated guesses about where the rising DTI ratio might lead:

Soft Landing: Housing prices might experience a moderate correction, wages could rise, and lending standards tighten, creating a more balanced market. This scenario would be the most desirable outcome.

Sharper Correction: A significant economic downturn could trigger foreclosures and mortgage delinquencies, destabilizing the housing market. This scenario would have severe consequences for homeowners and the broader economy.

The Federal Reserve's actions to curb inflation and government policies aimed at increasing housing supply will play a critical role in shaping the future. Individual caution is also paramount.

Taking Charge: Owning Your Homeownership Journey

Regardless of the broader market trends, prospective homebuyers should take proactive steps to safeguard their financial future:

Prioritize Affordability: Don't overextend your budget. Focus on finding a home with a mortgage payment that comfortably fits within your income.

Maintain a Healthy DTI Ratio: While the exact "healthy" level can vary, a DTI below 36% is generally considered desirable.

Build a Financial Buffer: Having an emergency savings fund can act as a safety net during unexpected financial hardships.

By taking these steps and approaching homeownership with financial responsibility, individuals can become more resilient to potential market downturns and achieve sustainable homeownership.

The American dream of homeownership remains achievable, but navigating the current DTI trend requires a cautious and well-informed approach. By understanding the economic factors at play, advocating for sound policies, and prioritizing financial responsibility, we can ensure that homeownership continues to be a path to prosperity for generations to come.